On Friday, January 26, 2024, Solutions for Our Climate (SFOC) and the Sustainable Shipping Initiative (SSI) held a special industry seminar in Seoul to discuss the linkages between steel decarbonisation pathways and the use of green steel in the shipbuilding and shipping sectors.

The seminar created an opportunity for stakeholders from the steel, shipbuilding, and shipping sectors to meet and build a shared understanding of the decarbonisation challenge and the potential for mutually beneficial collaboration in addressing steel emissions.

Opening remarks

Founder and CEO of SFOC, Joojin Kim, opened the event by highlighting the severity of the climate crisis, as 2023 was another record-breaking year in terms of heat waves, forest fires, and floods. He emphasised the need for industrial sector emissions to be addressed as part of global efforts to avoid the worst impacts of the climate crisis, and called for collaboration between stakeholders – across government, steelmaking, and shipping and shipbuilding – to create a stable green steel value chain.

He said: “South Korea has the world’s sixth-largest steel industry and the leads the shipbuilding industry, which is the third-largest steel consuming industry. Last year, the Ministry of Trade, Industry and Energy established a plan to build an ecosystem for steel scrap industry, develop the world’s first hydrogen fluidized bed reactor technology, and complete the value chain for steel for future green ships. In order to implement these plans, the government needs to strengthen close cooperation with the shipping and shipbuilding industries. I hope that today’s event will serve as an opportunity for the Korean steel, shipbuilding, and shipping industries to come together to discuss decarbonization and resource circulation in their respective industries, and how they can enhance their domestic and global competitiveness while responding to the climate crisis.”

CEO of SSI, Steven Jones, followed with a message calling for active engagement and collaboration among stakeholders to address the knowledge gaps in shipping’s use of green steel, bringing together technical expertise, policy mechanisms, and industry ambition to drive transformation.

He said: “Together, we are united by our vision to drive action for a sustainable shipping industry. We recognise that addressing the systemic issues we face today requires collaborative efforts to maximise impact, and the focus on green steel and shipping is part of that. Shipping scraps high quality steel and should demand green steel in return. But production barriers, availability and quality perceptions remain. Pioneering commitments from industry leaders will promote wider adoption, but collaboration is crucial. The link between our industries highlights the urgent requirement for combined efforts to cut emissions and transition to circular business models.”

South Korean steel decarbonisation and the role of steel scrap

Haebin Gahng, Senior Researcher at SFOC, then gave a presentation on the state of steel decarbonisation in South Korea. The highlighted the role of the Korean steel industry as an important material supplier for major industries, including shipbuilding – South Korean shipbuilding accounted for nearly 30% of global shipbuilding in 2022. South Korea is the 6th largest steel-producing country worldwide, accounting for 3.8% of global production in 2021 (corresponding to 71.4 million tonnes of crude steel).

She said: “Until innovative decarbonization technology is commercialized, the Electric Arc Furnace (EAF) will drive the decarbonization of the steel sector. Therefore, a global competition for securing steel scrap is anticipated. To increase the domestic procurement rate of steel scrap in Korea, where steel accumulation is low and import dependency is high, it is necessary to establish a circular economy system throughout the entire lifecycle of steel, from production to disposal. Nurturing a small-scale scrap industry and promoting cross-sectoral cooperation between steel producers and consumer industries could be viable approaches in this regard.”

In addition to this, she pointed to the need for policy support, such as easing waste regulation to facilitate import of scrap steel (in force since January 2024); cross-industry cooperation between demand and supply sectors (e.g. shipbuilders and steelmakers); as well as use of technology to improve steelmaking and scrap sorting.

Green steel for green shipping

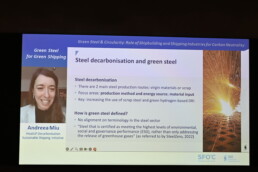

Andreea Miu, Head of Decarbonisation at the SSI, introduced SSI’s work on the topic of green steel and shipping. This work has identified the links between the two sectors’ decarbonisation efforts and the potential of steel as an entry point to greater circularity in shipping.

She said: “The steel sector is both a buyer of shipping services as well as a supplier of steel for shipbuilding. The opportunity for emission reduction when shipping and steel work together is huge, with recent research estimating that shipping could save nearly 800MtCO2 cumulative emissions by 2050 by progressively adopting green steel. South Korea, responsible for 30% of global shipbuilding in 2022 as well as the 6th largest steel producer worldwide has a crucial role to play in supporting the simultaneous sustainability transition of these industries, and we look forward to continued progress and leadership to achieve zero emission by the middle of this century.”

The presentation outlined the following necessary next steps:

- Marine grade green steel needs to be widely understood and promoted by classification societies, working in tandem with shipbuilding yards to raise awareness of the possibilities for green steel in shipping.

- Shipping can act as a green steel demand sector to show demand, and work with others to create a market and secure future supply.

- Understanding how tracking, verification, and assurance of GHG emissions savings, and sustainability benefits associated with green steel can work, both within shipping and broadly for steel demand sectors.

- Material flows for steel at end-of-life with a focus on high-quality uses in regions with current or potential ship recycling industries.

A brief Q&A with the audience discussed the applicability of the Extended Producer Responsibility concept and called for reflection on how such a concept would apply to the complex vessel landscape, as well as the value of traceability through something like a digital product passport, drawing comparisons to the existing Inventory of Hazardous Materials (IHM). In addition to this, there was agreement that the global landscape for the steelmaking, shipbuilding and ship recycling sectors may change in the long term, creating new markets and dynamics that could alter the way we think about green steel for shipping.

Lifecycle Assessment of a ship: LCA study presentation

Se-Jun Kim, New Construction Product Manager at Lloyd’s Register, brought concrete experience to the discussion as he shared learnings from a Lifecycle Assessment (LCA) study. Se-Jun Kim’s presentation focused on Scope 3 emissions – indirect value chain emissions – which are not only often the most significant but also the most challenging to measure, as they are outside of a company’s direct scope of influence. However, the trend is moving toward increased pressure from regulators, finance, and other stakeholders to request that these emissions be measured and reduced, thus creating incentives for organisations to begin understanding and addressing Scope 3.

He emphasised that the current priority from a ship lifecycle perspective remains the fuel emissions, which make up the majority of lifecycle GHG emissions for a ship. However, at the shipbuilding stage, steel plates are a key source of emissions to address. He said: “When it comes to the ship construction stage, the largest source of GHG emission is coming from steel plates. The industry and regulators now focus on measures to reduce GHG emissions from the operation of a ship, and this will result in the reduction of GHG emissions gradually. The next focus will be on steel plates. In the near future, the supply chain and distribution chain will drive the transition from alternative fuels to green steel as the upcoming trend.”

Panel discussion: In conversation with industry

Finally, a 45-minute panel gave participants a chance to engage in a dynamic discussion between industry actors, consisting of:

- Kyungsik Kim, Head of the Steel Scrap Research Center

- Hemy Bae, Manager, Sustainability Strategy Consulting at Schneider Electric Korea

- Se-Jun Kim, New Construction Product Manager at Lloyd’s Register

The panel, moderated by Heather Lee, Steel Lead at SFOC, focused on how to build an environment that fosters green steel production, use of steel scrap, and uptake by the shipbuilding sector as a steel consumer. With a focus on South Korea, panellists shared their experience of the challenges and opportunities to incentivising green steel from a technical, business, and regulatory perspective.

Learnings were also shared from other sectors, with reflections from Hemy Bae on emerging policy instruments to measure and regulate lifecycle emissions for sectors such as automotive in the European Union. She said: “Lifecycle assessment is unfamiliar to us yet, but policies regulating the lifecycle emissions have already started. The EU is already implementing lifecycle-based CO2 standards for new cars and vans, and recently officialised the EU Battery regulation which obligates battery makers to account and declare a product’s carbon footprint throughout the lifecycle from 2025. The issue is that these regulations are not only applied to European companies, but all products imported to Europe. The scope of lifecycle emissions regulation will be further expanded to broader sectors such as electronics in the future. The shipbuilding industry should be aware of this trend and be prepared considering the sector is quite carbon intensive.”

Kyungsik Kim pointed to the 1% recovery rate for domestic scrap steel in Korea, whilst at the same time there is significant demand for scrap which is imported at higher costs. He called for improvements in the sector to make it more efficient as well as cheaper, making scrap more attractive as well as accessible for steelmakers. He noted that “To foster a sustainable society, prioritizing resource recycling is essential. The most significant example is steel scrap; by utilizing it, you reduce the CO2 emission intensity of the produced steel. Government support is needed to increase the scrap collection rate and its utilization. From a steelmakers’ perspective, delivering high-quality steel at an affordable cost and on time is crucial, underscoring that a stable and cost-effective steel scrap supply chain is required to reach steel decarbonization.”

A key part of the discussion among panellists was the challenge of green hydrogen supply which limits the potential for green steel production through renewable energy use. Instead, Hemy Bae shared a reflection on the potential of steel production through increased scrap content where the energy mix does not currently allow for renewable energy use in activities as energy-intensive as steelmaking. She further reflected on the lack of technical knowledge and expertise across industries around the practicalities of scrap steel use, with concerns about quality and impurities, as well as the need for infrastructure to sort and re-process scrap steel, removing impurities and ensuring better quality-retention.

Se-Jun Kim and Kyungsik Kim both pointed to competitiveness and the benefits South Korea enjoys due to its unique position as a key market for both steelmaking and shipbuilding. Se-Jun Kim discussed the view that future competitiveness will not only focus on commercial and quality aspects but will also focus on environmental aspects, creating an opportunity for South Korea to further strengthen its competitiveness in the shipbuilding market by catering to this need.

The audience Q&A focused on the stakeholder landscape and who bears the responsibility and the cost of using green steel, with panellists agreeing that in any category, such products would bear a higher price to the end user.

Thank you to all event participants who took part, in person or online, to make this event a success. If you have any questions, or wish to get in touch with the organisers, please reach out to Kate Kalinova, kate.kalinova@forourclimate.org or to Andreea Miu, a.miu@sustainableshipping.org.

About Solutions for Our Climate

Solutions for Our Climate (SFOC) is a nonprofit organization established in 2016 for more effective climate action and energy transition based in Seoul, South Korea. SFOC is led by legal, economic, financial and environmental experts with experience in energy and climate policy and works closely with domestic and international players.

About the Sustainable Shipping Initiative

The Sustainable Shipping Initiative (SSI) is a member-led group of leaders catalysing change across the maritime ecosystem. Since 2010, SSI has brought together shipowners, operators and managers; banks and financial stakeholder; cargo owners; classification societies; non-profits; ports; and service providers to advance environmental, social and economic goals for a sustainable shipping industry.